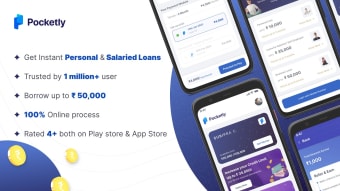

A loan app for Indian youth

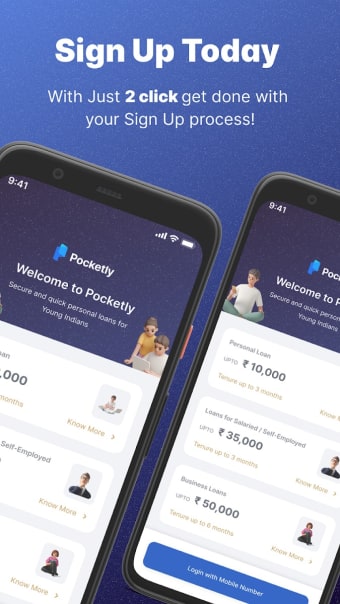

Pocketly : Personal Loan App, or simply Pocketly, is a free app where Indians 18 years and above can apply for loans to finance any need. It is aimed at not only employees, but also self-employed and non-salaried individuals.

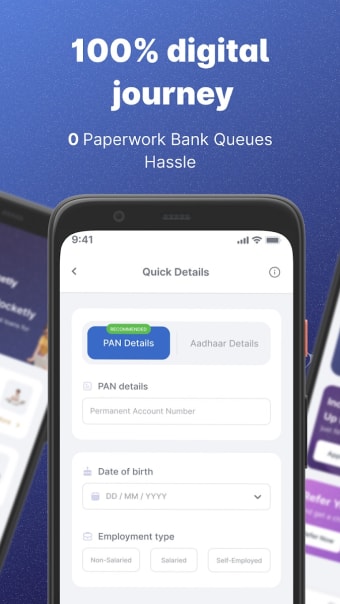

To get started, the client must submit their Aadhaar and PAN (permanent account number) cards. If they’re a salaried employee—they must also upload their employee ID and bank statement. However, loan disbursement times vary between salaried and non-salaried clients, with the former receiving their loan in 24 hours and the latter receiving theirs in an hour.

Apply and repay your loans

Certified by ISO 27001, Pocketly : Personal Loan App offers loans amounting up to ₹50,000. Loans have a maximum repayment term of 120 days, an annual percentage rate (APR) ranging from 30 to 99 percent, and monthly interest rates falling between 2 to 3 percent. However, as with some loan applications, this app charges a minimum processing fee up to 7.5 percent.

It offers three repayment methods: debit card, online banking, and UPI (unified payments interface). As the app displays your repayment schedule, you’ll be able to prepare your next monthly payment ahead of time. You can also increase your disbursal limit, so long as you apply and repay your loans on time. As a bonus, you get an additional ₹500 if you refer your friends to the app.

While this app generally promises hassle-free sign-up and loan application, some borrowers have experienced long verification times and delayed OTP sending. The latter is the most problematic of all since without an OTP, you won’t be able to access your account and repay your loan. Though technical and account-related issues can be reported to the app’s customer support, be warned that they take too long to address such issues.

Funds at your fingertips

Though aimed at Indian youths, Pocketly : Personal Loan App provides clients with access to cash that they can repay within a period of time. Frequent applications and timely repayments are rewarded with loan disbursal increases, which is a plus if you need additional funds for a particular financial need. What’s more, you can earn ₹500 for referring your friends. However, the log-in issues are one of the app’s drawbacks.